by Tony Joshie

If you are an online shopper, then by now, you understand the essentiality of a credit card - a virtual one. A Virtual Credit Card, also called VCC, has numbers that are used in online transactions. The authenticity of these numbers determines whether the transaction will go through or not. Anyone is liable to get a VCC, as long as you know how to use one.

Contents

This type of card performs the same function as bank credit cards, but it is safe if you had one strictly for online transactions. Now, to get one is not so difficult but you should learn one or two about companies that produce these virtual cards. Below is a detailed description of the best virtual credit providers; however, you should learn why you need a Virtual Credit Card before getting into these companies.

For online stores who accept various means of payment, including VCC, you will find it safe and easy to use on them. It is a fast process as long as there are funds in the card, and you provide all the necessary information needed.

Unlike your bank credit cards, you can set limits to what you can withdraw or spend on a Virtua Credit Card. Also, you can extend if you want to; in essence, you have control over your spending.

If you would like to change currency, this card can do that. You don't have to worry about currency-barrier because here is a feature on the card that helps you set into whatever country currency you want.

Check out the following credit card providers.

A popular company known for cross border payment for goods and services is Payoneer. It is widely used by freelancers, online sellers and so on, as a medium of payment. With Payoneer Virtual Credit Card, things become easy, especially for online transactions. It is a prepaid card that is only accessible for a mass payout company account owner. During the account creation, a few vital details, such as name, username, email address, date of birth, etc., are requested to prove the legitimacy of a prospective card owner.

Normally, Payoneer being a reliable company, boasts of two impressive achievements - low fees and global recognition. The Payoneer VCC is universal ; i.e., it is not limited by factors such as currency barrier. Indeed, it offers an incredible virtual card service to pay VAT, suppliers, and so on.

Another incredible virtual credit card provider that offers prepaid cards for online transactions is Netspend. This card is very useful to most online shoppers because of some benefits they get to enjoy from its use. For instance, Netspend does not have an activation fee, unlike many others that require a user to pay a certain fee before cards can be used.

In the same vein, Netspend does not require a user to have a minimum balance. However, this virtual card company often requests that potential users register on their platform before the card is made available for use. The identity verification process is not so time-consuming, as known details are requested.

Most importantly, users should bear in mind that Netspend does not need a credit score before it is delivered for use; thus, anyone can make use of this virtual card.

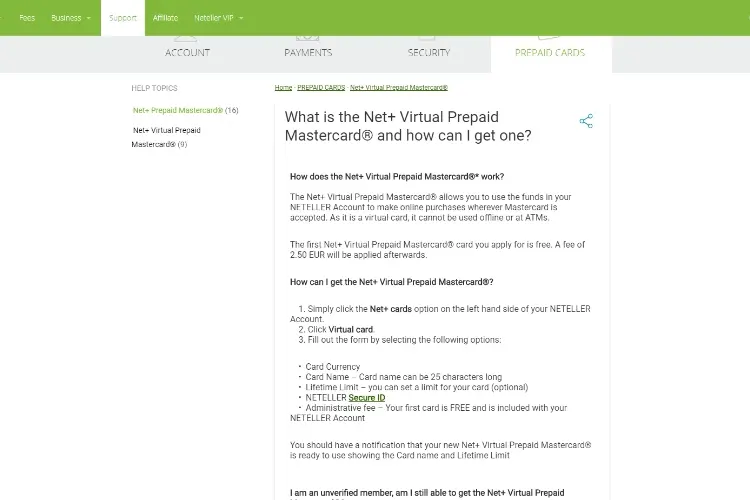

Neteller is a fantastic company that allows you to perform online transactions seamlessly. This card provider has a Net+ Virtual Prepaid Mastercard that can be used across different platforms that accept this kind of card. Getting this card for the first time is free; however, a service charge of $2.50 is requested on subsequent application.

On how to use a Net+ Virtual Prepaid Mastercard, all you have to do is fund your Neteller account and make purchases with the card. Since it is a virtual card, it can only be used when you are online.

On Neteller site, click the Net+ option, and then "Virtual Card." Fill out all the information requested, such as card currency, card name, limit; accept the terms and conditions. Immediately, your card becomes ready to use.

For a corporate card program via virtual credit card, American Express Go is an excellent choice to use. It is an easy and flexible way to make payments online; hence, a reason why freelancers, retailers and contractors often use it. This virtual card also comes in useful when you are on-the-go so that you are not limited by currency barrier.

American Express Go is a fantastic way to control your spending and control every transaction carried out. All you have to do is create a profile on the portal with an option to send card details to you. Now, you will be able to see your card details on the AmEx Go app - a mobile wallet for transactions. Download the app on Google Play Store and App Store to get started.

Walmart, as a company on its own, has won the hearts of many people with top-notch delivery of services. Now, the company decided to go further by providing their virtual credit cards so that customers can get all they need without issues. This Walmart card can be used anywhere with a good management plan.

On Walmart MoneyCard, you can add up to 4 members on the application with ease. In the same vein, you have an opportunity to send money and track spending every day. There are 2 special features on this virtual card provider's app - a 2% interest APY on savings up to $1000, and cashback at Walmart up to $75 per year.

For queries and complaints, Walmart MoneyCard has good customer support to attend to all issues.

The Freecharge Go Mastercard will leave you stunned when you want to make transactions online. This virtual card provider has an app to make users welcomed as regards online spending. As long as you use a Mastercard on an eCommerce site, a Freecharge Go VCC should work as well.

Freecharge Go Mastercard has an MPIN feature that allows you to secure your virtual card in the best way possible. This safe shopping experience is further enhanced with 128-bit encryption as well as PCI-DSS compliant. Indeed, this virtual credit card aims at working in the interest of every online shopper or contractor or freelancer.

For both prepaid virtual Visa and Mastercard, Ezzocard is a great choice for your online shop. This credit card provider uses a premium automated service coupled with excellent delivery to satisfy user all around the world. This card is somewhat private, as it allows you to pay for goods online in anonymity; thus, it is quite different from many other types known. Besides, it offers a wide range of currency types to eliminate barriers.

Also, this credit card provider offers 3 different types of cards - Brown, Green and Blue. Each of the cards has specific features and a validity period that makes them useful. Furthermore, they all support the Address Verification System for safety and security concerns. In essence, these cards can be linked to shopping platforms for convenience as long as relevant information is provided.

A final choice on the list of the best virtual credit card providers is the Kotak Netc@rd that assures users of safe and secure transactions online. The virtual credit card provider, Kotak Mahindra Bank Netc@rd, promises an excellent prepaid card service with no hassle for stress-free shopping. However, your bank account will be involved in the usage of this virtual card.

Kotak Netc@rd is a unique payment service that has an acceptable card on all shopping platforms. It does not cost anything to own this virtual card; likewise, no minimum balance is required. All you have to do to get started is log on to the website, and register for a virtual card. Link whatever you have to and get your credit card in a few moments.

Since VCC are used in the online world, then a user needs to be careful in every way possible. Even if a card provider assures you of safety and security, you need to do much for yourself. For instance, you shouldn't use your card on a site not listed because your details are endangered if you provide them.

Also, try to make inquiries about a provider or site before you register your details with them. Some of these websites only need relevant information about you to get access to other things that pertain to you.

Above is a clear description of the best virtual credit providers online and the ways they satisfy clients all over the world. Indeed, transactions online have been made easy with the prepaid visa and Mastercard from these companies. Some of them even have mobile apps to enhance better customer experience. Without a doubt, this information is vital to help you with knowing a credit card provider to go for against your next online payment.

About Tony Joshie

Tony's journey as a blogger began several years ago when he discovered his love for the visual arts. Fascinated by the stories behind the masterpieces and the artistic techniques employed by renowned artists, he started sharing his thoughts and interpretations on his blog.

|

|

|

|

Popular Posts

Try FREE Gifts right here, right now. Or receive Freebies Goodies nothing but cool items.

Once successful, button below

|

|

|

|